Ever been filling out a form to set up direct deposit or link a payment app, and hit a wall when it asks for something called a routing number? If you’ve stared blankly at your screen wondering what on earth that is, you’re not alone. Most people know their bank account number by heart but give a shrug when it comes to this nine-digit mystery.

But here’s the thing — that seemingly random string of numbers isn’t just a formality. It’s essential. Especially if you’re in the US and regularly move money around. So let’s clear the air. No jargon. No fluff. Just plain English explaining what is a bank routing number, why it matters, and where to find it when it counts.

A bank routing number is a unique nine-digit code that tells banks where to send or receive money. It’s like a bank’s fingerprint. Think of it as a mailing address — but for your money. Without it, your direct deposit, bill payment, or wire transfer would just float aimlessly in the banking void.

The technical name? The American Bankers Association (ABA) routing number. Yep, it sounds fancy. But it simply helps identify which financial institution holds the account you’re dealing with — whether it’s your own or someone else’s.

Now, this isn’t just something the bank made up to complicate your life. It’s an official identifier issued to financial institutions that are eligible to maintain accounts at the Federal Reserve. Basically, it helps keep the money flowing to the right places.

Well, for starters, you can’t get paid without it. If you’re setting up direct deposit with your employer, the first thing they’ll ask is for your bank routing number. Same goes if you’re linking your bank to PayPal, Venmo, or Payoneer.

Without it, there’s no guarantee your money will end up in the right hands — or accounts. And that’s a headache no one wants.

Need to send money to a friend? Pay your mortgage? Reorder checks? Transfer between different bank accounts? You’ll need your routing number. It’s like the backstage pass that gets your funds where they need to go.

Here’s where it gets kind of cool. That nine-digit number isn’t just slapped together. Each part has meaning.

It’s wild how much information is packed into just nine numbers.

Not every day. But definitely often enough that it’s worth knowing where to find it. Here's where that routing number comes into play.

So yeah, it shows up a lot more than you might think.

Believe it or not, not all routing numbers are created equal. Here are a few types that pop up depending on the transaction or account type.

This is the most common and what most people mean when they say “routing number.” It’s used for direct deposits, online payments, check processing — basically, everyday banking stuff.

These aren’t used in the US. But if you’re dealing with international banking, this format will show up. It’s longer. Alphanumeric. And helps banks across borders communicate.

Short for Electronic Transfer Account. These are used by certain government programs to process federal payments into low-cost bank accounts.

So if someone ever throws around acronyms like IBAN or ETA in a money convo, now you know they’re not just making things up.

You May Also Like: Secure Mobile Banking Setup - Follow These Steps Now

If you’re suddenly panicking because you don’t have your checkbook (who does these days?), relax. There are plenty of places to find your bank routing number.

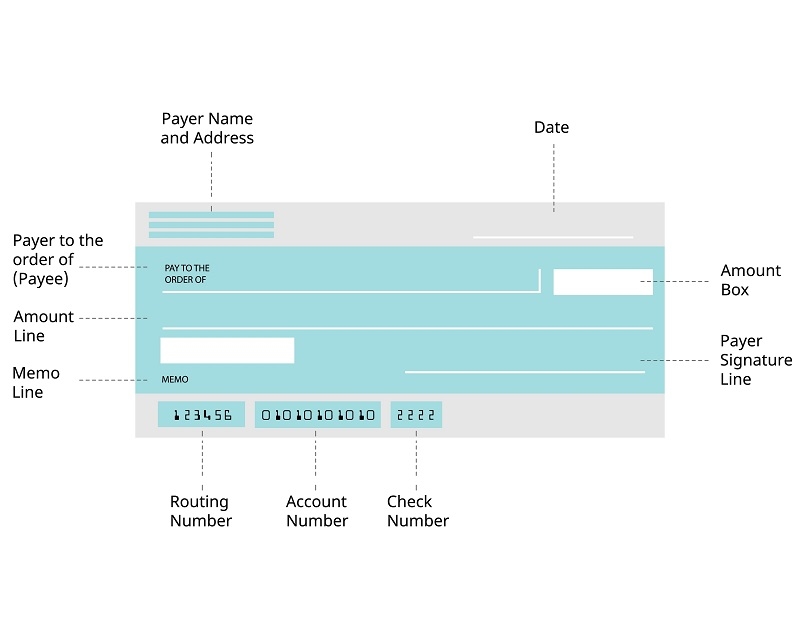

Old-school but reliable. It’s that first nine-digit number in the bottom-left corner of your check. The one before your account number.

Log into your account through your bank’s website. Go to the account summary or details section. It’ll be there.

Most banking apps list your account and routing number under account info or details. Easy to copy and paste when needed.

If all else fails, just Google “US bank routing number” + your bank’s name. Many banks post a list based on your state or branch.

If you bank with Associated Bank, you might be specifically looking for the Associated Bank routing number. It’s 075900575, but — double-check. Some banks have multiple routing numbers depending on your location or the type of transaction.

It’s always safer to verify via your bank’s official channels rather than relying on memory or third-party sources. A single wrong digit can delay or mess up a payment.

Yes, even non-traditional banks use routing numbers. For example, Payoneer assigns users a virtual bank routing number so they can receive ACH transfers in USD. That means if someone in the US wants to pay you, they can treat your Payoneer account like any regular checking account.

It’s smart. It’s seamless. And it’s one reason understanding how to find routing number details is super helpful even if you’re using newer platforms.

With everything becoming more digital, financial info is flying around faster than ever. But that also means more chances for errors. That’s why knowing your routing number — and entering it correctly — matters so much.

A mistyped bank routing number doesn’t just delay things. It can send your money to the wrong account. Or worse, get it lost in transaction limbo. And no one wants to be on hold with the bank for three hours trying to fix that mess.

Let’s say you freelance online and work with clients across the country. You need to get paid, right? So you share your account number and routing number to set up ACH payments. The client plugs in the info, sends the payment, and bam — it lands in your account. Smooth. That only works because the routing number told their bank exactly where to send the money.

Or maybe you're using a budgeting app that links to your checking account. The app needs your routing number to pull in transaction data and help you track your expenses. It can’t do that without knowing where your bank account “lives,” digitally speaking.

Don’t go sharing your routing number on social media or with people you don’t trust. While it's not as sensitive as a password or PIN, it’s still tied to your financial account. Combine that with your account number, and someone could attempt unauthorized withdrawals or create fake checks.

So yeah, treat it with a little care.

Related Resource: Cybersecurity in Banking: Risks, Breaches & Solutions

At the end of the day, this isn’t one of those obscure banking terms you’ll never use. Your routing number is part of everyday money management. It helps your paycheck land in your account. It keeps your bills paid on time. It connects your bank to the digital world.

So if someone ever asks what is a bank routing number, now you’ve got an answer that actually makes sense. And next time you're asked to type it in? You’ll know where to look. You’ll know why it matters. And you’ll be one step closer to handling your money like a pro.

Because honestly, banking shouldn’t be a mystery. And a little knowledge can go a long way toward keeping your financial life on track.

This content was created by AI